Over the past 21 years, with the support of our customers, we have been able to invest and grow our presence in the UK. We wanted to share a snapshot of our broader economic impact in the UK during 2019, including our tax contributions, to provide a better understanding of our business and how we support the communities where we operate.

2019: Our investment in the UK

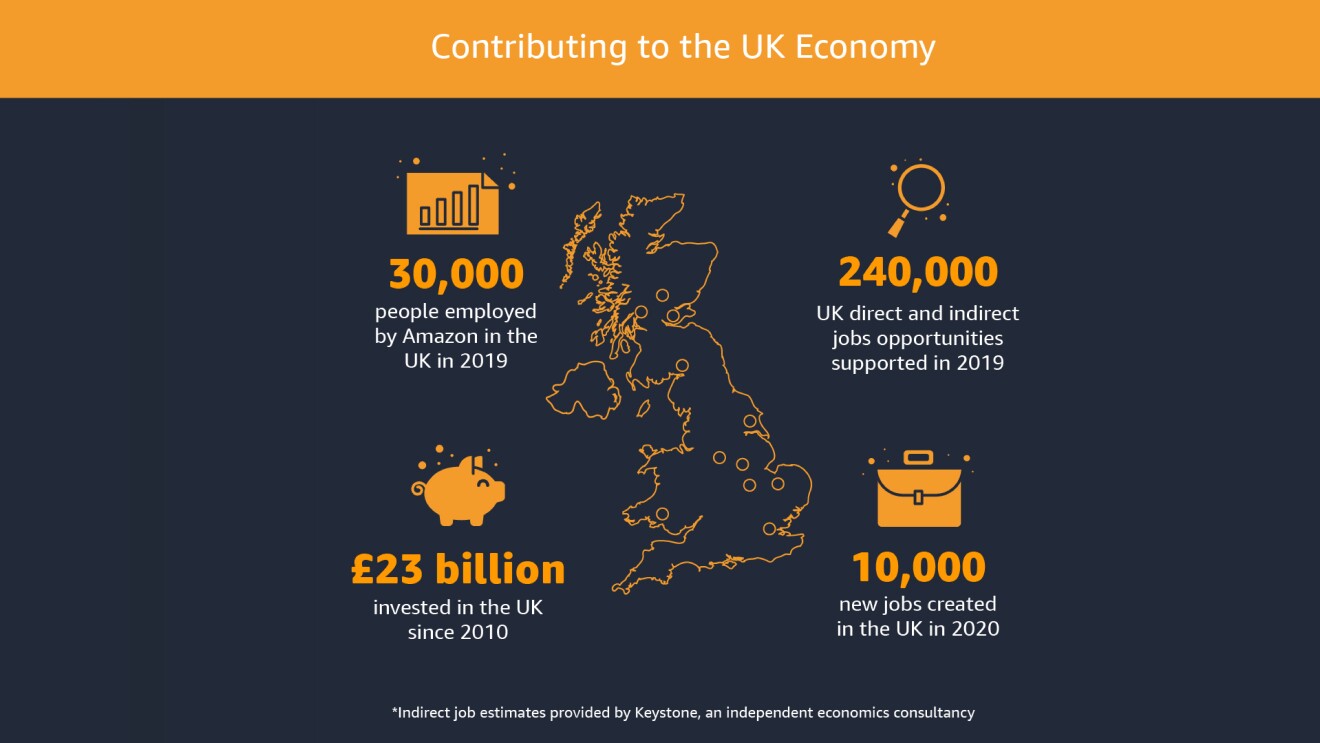

Since 2010, we’ve made direct investments in our UK operations of more than £23bn. This includes both capital expenditure (such as the infrastructure we build, such as our fulfilment centres, corporate offices and data centres), and operating expenditure (such as the jobs we create in the UK). These direct investments raise the economic activity in a given region. This investment also creates a ripple effect through the economy as the firms that supply goods and services to Amazon expand and associated houshold spending increases. Keystone, an independent macroeconomic consultancy, estimates Amazon’s investments have led to the production of goods and services that contributed more than £30bn to the UK’s GDP since 2010.

At the end of 2019, we directly employed more than 30,000 people in the UK, including at our R&D operations in Cambridge, Edinburgh and London, corporate office in Manchester, AWS data centres in London and at more than 20 state-of-the-art fulfilment and distribution centres across the country.

We recently announced that we are creating a further 10,000 permanent roles across the UK in 2020, taking our total permanent workforce to more than 40,000. The new roles, including engineers, graduates, HR and IT professionals, health and safety and finance specialists, as well as the teams who will pick, pack and ship customer orders, will help Amazon meet growing customer demand and enable small and medium sized enterprises selling on Amazon to scale their businesses. As a result of our investments, the UK has become one of our largest global hubs for talent.

In addition to our direct job creation, our investment indirectly supports a large number of jobs in our UK supply chain and across the network of sellers who have used our technology and services to grow their businesses through increased sales within, and beyond, the UK. Keystone’s economic research estimates that companies in Amazon’s supply chain (including, for example, in building services, property services and professional services) supported 125,000 additional job opportunities in 2019.

Many of these job opportunities are in parts of the UK with a history of higher unemployment and lower investment. For example during 2019, in the North West of England based on Keystone findings it is estimated that Amazon investment contributed more than £945m to value-added GDP and created approximately 14,800 direct and indirect job opportunities.

Our business has also provided opportunities for the tens of thousands of UK-based small and medium-sized enterprises (SMEs) who sell their products in Amazon’s stores across the world and use the tools and services we build to help them grow. More than 60% of these businesses selling through Amazon Stores export to customers all over the world, and in 2019 alone, they achieved total export sales of more than £2.75bn and supported more than 85,000 job opportunities in the UK. Moreover, many of these selling partners are located outside of London, in areas such as the North of England and the Midlands, and generate over 40% of total sales volume.

If you combine our direct employment with these indirect employment effects, this means that Amazon enables employment for more than 240,000 people across the UK.

2019: Our tax contributions in the UK

As we continue to make investments in our UK operations and our growing workforce, we help fund public services and infrastructure throughout the country. We do this through the taxes that are collected by the Exchequer as a consequence of our activities in the UK. Those taxes fall into two categories:

- Directly incurred taxes: the taxes that are directly incurred and payable by Amazon, including Employer National Insurance, business rates, Corporation Tax, import duties, and Stamp Duty Land Tax; and

- Indirect taxes collected: the taxes we collect and remit from our customers, employees, and other third parties because of our business activities in the UK. These include VAT and the taxes paid by our employees through PAYE.

It’s important to understand both of those categories, because indirect contributions to government revenue would not be collected (or generated to the same extent) if we did not offer services or products to our customers who are responsible for paying the tax in question, or if we did not procure goods and services from our suppliers on which such taxes are due. This means that focusing on one aspect of taxation, such as Corporation Tax doesn’t tell the whole story.This is one of the reasons why PwC produces a total tax contribution study for The 100 Group (an organisation which represents the Finance Directors of the UK’s largest companies, including many FTSE 100 firms).

This trend is particularly relevant for growing businesses like Amazon which continues to invest in its workforce and infrastructure. Amazon also has a high volume of sales, but operating profits remain relatively low due to price pressure in competitive markets, intense capital investment programmes, and increasing operating costs.

Most governments —including the UK Government—actively encourage companies to make these investments, and they often use the taxation system to do so. Capital allowances and R&D credits are designed to stimulate the kind of investment necessary to grow the economy and create jobs. These reduce Corporation Tax, however this is more than made up for by the increased tax revenue or lower costs for the Government in other areas.

Last year we published our UK investments, directly incurred tax charge and indirect taxes collected for the first time. Our definition of which taxes are included in directly incurred taxes and indirect taxes collected remains the same as our 2018 disclosure. Below we have outlined our contribution for the full year to 31 December 2019:

- In 2019, the total revenues of Amazon’s activities in the UK were £13.73bn (2018: £10.89bn)

- We invested more than £690m in our infrastructure (2018: £625m) following an expansion of our fulfilment centre portfolio and corporate real-estate (new corporate office in Manchester).

- Our total directly incurred taxes were £293m (2018: £220m). Employer taxes accounted for the largest proportion of these, followed by business rates, Corporation Tax, and then other taxes such as Stamp Duty Land Tax. Increases during 2019 have largely been driven by headcount growth and increases in accounting profits.

- The indirect taxes we collected were an additional £854m (2018: £573m) as a result of our business activities in the UK. Increases during 2019 were largely driven by Net VAT due to an increase in sales and employee taxes as the result of headcount growth and wage increases.

- Our total tax contribution (combining direct and indirect) was therefore £1.147 billion (2018: £793m).

2020: Helping the UK through COVID-19

The figures set out above relate to our performance for the full year to 31 December 2019. However, during 2020 and throughout the COVID-19 crisis we’ve learnt how important Amazon has been to our communities and customers. With our scale and ability to innovate quickly, we have been fortunate to be able to help make a positive impact during this difficult time. With that in mind, we have not taken up any Government support schemes related to the pandemic. While we know life will be different for a while longer, we thought now would be a good time to look back at how we have been responding so far.

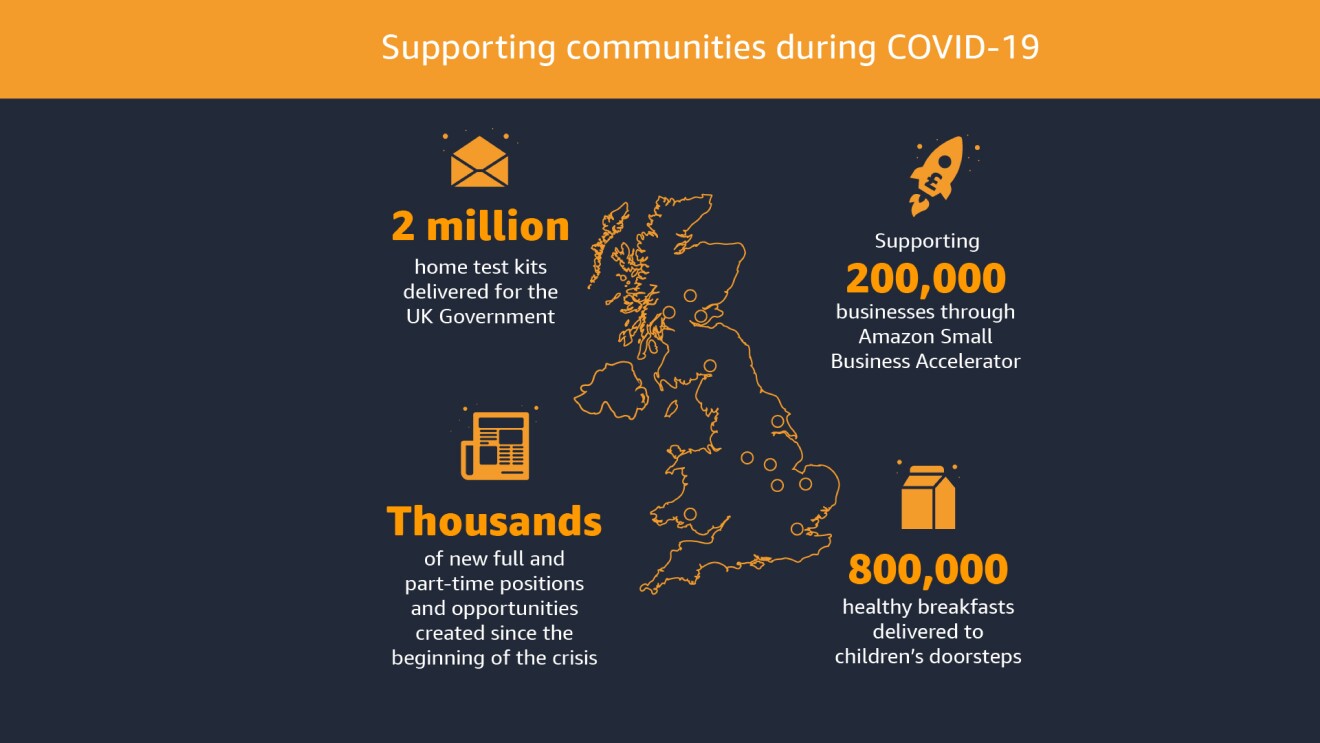

To help serve our customers, we have opened thousands of new full and part-time positions and delivery driver opportunities across our UK logistics and fulfilment centre network since the beginning of the crisis. For many who have had to put their business or work on hold due to the outbreak, a role at Amazon has provided a welcome opportunity.

We have also partnered with Enterprise Nation, to launch the Amazon Small Business Accelerator, a support package for more than 200,000 small businesses across the UK. We are also proud to be leveraging our logistics network to deliver 800,000 healthy breakfasts to families around the UK and to deliver over 2 million test kits to homes around the country as part of the support we are providing to the UK Government to boost testing capacity for COVID-19.

In addition, we’re supporting other efforts in the UK and around the world to address the crisis, including AWS working closely with the World Health Organisation to accelerate the effort to track the virus, understand its outbreak and to better contain its spread. AWS is also helping to provide infrastructure and technology to enable NHSX - a joint unit between the Department of Health and Social Care, NHS England and NHS Improvement - to quickly and securely launch a Covid-19 response platform for critical public services. This is in addition to the other organisations we have supported to ensure the UK’s school children can still get an education, small businesses can remain online, and the UK’s digital businesses keep running.

We are proud of the work our teams have been doing during this difficult time. Looking beyond the immediate crisis, we know that the UK remains full of opportunity and we continue to be excited by the potential to continue to invest, invent, and create jobs and income in communities across the country.